BEIJING, Dec. 05, 2019 (GLOBE NEWSWIRE) -- 9F Inc. (“9F” or “the Company”) (NASDAQ: JFU), a leading digital financial account platform integrating and personalizing financial services in China, today announced its unaudited financial results for the third quarter ended September 30, 2019.

Third Quarter 2019 Operational and Financial Highlights

- Loan origination volume1 was RMB21.4 billion (US$3.0 billion) in the third quarter of 2019, representing an increase of 253.9% from RMB6.0 billion in the same period of 2018. Loans funded by institutional funding partners2 accounted for 78.6% of total loan origination volume in the third quarter of 2019, an increase from 58.0% in the second quarter of 2019.

- Number of registered users3 was 95.7 million as of September 30, 2019, representing an increase of 47.2% from 65.0 million as of September 30, 2018 and an increase of 15.6% from 82.8 million as of June 30, 2019.

- Number of active borrowers4 was 1.4 million in the third quarter of 2019, representing an increase of 243.8% from 0.4 million in the same period of 2018.

- Outstanding loan balance5 was RMB72.5 billion (US$10.1 billion) as of September 30, 2019, representing an increase of 40.4% from RMB51.6 billion as of September 30, 2018.

- Total net revenues were RMB1,705.5 million (US$238.6 million) in the third quarter of 2019, representing an increase of 80.5% from RMB945.0 million in the same period of 2018, and an increase of 63.0% from RMB1,046.5 million in the second quarter of 2019.

- Net income was RMB10.5 million (US$1.5million) in the third quarter of 2019.

- Adjusted net income6 was RMB245.0 million (US$34.3 million) in the third quarter of 2019.

Mr. Lei Sun, Chairman and Chief Executive Officer, commented, “I am pleased to report solid operational and financial results despite a challenging regulatory and macroeconomic environment. We continue to transition our business towards a more capital light model through the implementation of our Technology Enablement Strategy to ensure we are ideally positioned to adapt to whatever regulatory environment finally emerges and are able to generate long-term sustainable growth. Evolving our business through the use of innovative technology is at the heart of this strategy and we took a few more steps forward in the third quarter of 2019 in executing on it. We officially launched our proprietary platform, 9F Superbrain, that integrates our core artificial intelligence, cloud and blockchain technologies. 9F Superbrain provides our financial institution partners and merchant partners with highly customized modularized service packages and the reception by the market so far has been great. We have also launched a SaaS version of this platform to drive our expansion into South East Asia and other international markets. We also established a research and development center in Shenzhen during the third quarter of 2019 to build an artificial intelligence and risk management team that is dedicated in streamlining our support for overseas markets, strengthening our risk management capabilities, and developing new and innovative modules and applications for our overall business development.”

“We are also encouraged by our expansion prospects both geographically and across different consumption verticals as we continue to explore partnerships with select vertically integrated merchants. Geographically, we are working on securing financial licenses before we scale up operations in target overseas markets to leverage our extensive experience and replicate the success we have achieved in China. Currently, we are exploring opportunities that relate to consumption verticals such as online retail, travel and beauty and social media, as we enable merchant partners to seamlessly offer financial services to their consumers. We will be targeting other consumption verticals as well in the future. We are pleased with the progress we’ve made in the third quarter of 2019. We will remain focused on leveraging our extensive experience to further reduce regulatory risk and deploying our strong cash position to invest in innovative technology to further scale up our business and generate long term sustainable growth.”

Mr. Yanjun Lin, Chief Financial Officer and Director, added, “Our nimble and proactive approach to serving our financial institutional partners through technological innovation has put us in a unique position to rapidly adapt to a changing regulatory environment and generate long term sustainable growth. I am pleased to see our total loan origination volume in the third quarter of 2019 come in at a record high of RMB21.4 billion, representing 253.9% in year-over-year growth. The record high loan origination volume was mainly driven by the significant increase in our active borrowers from 0.4 million in the third quarter of 2018, representing 243.8% in year-over-year growth. As of September 30, 2019, the number of registered users increased 47.2% year-over-year to 95.7 million and 15.6% from the end of the second quarter as we build momentum going into the end of the year. It is also encouraging to see that innovation within our ecosystem continues to drive demand from institutional funding partners, reflecting the increasing trust and confidence they have in us. We were able to further increase the proportion of total loan origination volume funded by institutional funding partners to 78.6% in the third quarter of 2019. Looking forward, with a strong cash position of RMB4,685.1 million (US$655.5 million) on our balance sheet, our focused investments as we shift to a more capital light model, and our proactive approach to capitalizing on emerging opportunities across different geographical markets and consumption verticals, we are confident we will continue to grow our business sustainably over the long-term.”

Third Quarter 2019 Financial Results

Total net revenues increased by 80.5% to RMB1,705.5 million (US$238.6 million) from RMB945.0 million in the same period of 2018, primarily due to the increases in net revenues generated from both loan facilitation services and post-origination services.

- Loan facilitation services increased by 81.4% from RMB818.0 million in the third quarter of 2018 to RMB1,484.1 million (US$207.6 million) in the same period of 2019, The increase of net revenues on loan facilitation services was primarily due to an increase in loan origination volume which was further driven by an increase in the number of active borrowers over the same period.

- Post-origination services increased by 51.0% from RMB99.1 million in the third quarter of 2018 to RMB149.6 million (US$20.9 million) in the same period of 2019, primarily as a result of an increase in our loan origination volume.

- Other revenues increased by 157.6% from RMB27.9 million in the third quarter of 2018 to RMB71.8 million (US$10.0 million) in the same period of 2019, primarily due to an increase in revenue from our online lending services generated in Southeast Asia and an increase of our domestic user referral service revenue.

Sales and marketing expenses increased by 126.2% from RMB342.0 million in the third quarter of 2018 to RMB773.5 million (US$108.2 million) for the same period of 2019, primarily due to an increase in our user acquisition cost.

Origination and servicing expenses increased by 343.8% from RMB97.2 million in the third quarter of 2018 to RMB431.3 million (US$60.3 million) for the same period of 2019, primarily due to an increase in fees paid to third party collection companies for loan collection services.

General and administrative expenses increased by 98.7% from RMB256.4 million in the third quarter of 2018 to RMB509.4 million (US$71.3 million) for the same period of 2019, primarily due to an increase in salaries and benefits of research and development personnel and share-based compensation expenses. General and administrative expense for the third quarter included share-based compensation expenses of RMB234.5 million.

Operating loss was RMB8.8 million (US$1.2 million) in the third quarter of 2019, compared with operating income RMB249.4 million in the same period of 2018.

Interest income was RMB47.8 million (US$6.7 million) in the third quarter of 2019, compared with RMB72.1 million in the same period of 2018.

Income tax decreased by 54.5% from RMB66.9 million in the third quarter of 2018 to RMB30.4 million (US$4.3 million) for the same period of 2019.

Net income was RMB10.5 million (US$1.5 million) in the third quarter of 2019, compared with RMB228.7 million for the same period of 2018.

Adjusted net income was RMB245.0 million (US$34.3 million) in the third quarter of 2019, compared with RMB362.6 million in the same period of 2018 and RMB205.8 million in the second quarter of 2019.

As of September 30, 2019, the Company had cash and cash equivalents and term deposits of RMB4,685.1 million (US$655.5 million).

Delinquency rates

As of September 30, 2019, the delinquency rates7 for loans that are past due for 15-30 days, 31-60 days, 61-90 days and 91-180 days were 0.08%, 0.10%, 0.11%, 0.42% respectively.

The following table displays the delinquency rates for all our outstanding loan products as of December 31, 2016, 2017 and 2018 and September 30, 2019:

Delinquent rate

| Delinquent for | ||||

| 15-30 days | 31-60 days | 61-90 days | 91-180 days | |

| 31-Dec-16 | 0.82% | 0.91% | 0.57% | 1.42% |

| 31-Dec-17 | 0.77% | 1.00% | 0.89% | 1.88% |

| 31-Dec-18 | 0.59% | 0.35% | 0.24% | 1.43% |

| 31-Mar-19 | 0.06% | 0.12% | 0.32% | 0.88% |

| 30-Jun-19 | 0.10% | 0.19% | 0.20% | 0.54% |

| 30-Sep-19 | 0.08% | 0.10% | 0.11% | 0.42% |

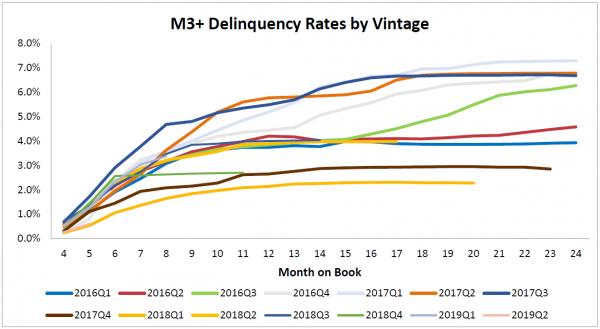

The following chart displays the M3+ delinquency rates by vintage8 for all our outstanding loan products. Loan products that have been transferred to non-performing loan companies are not included in the calculation of M3+ Delinquency Rates by Vintage.

A photo accompanying this announcement is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/f86a42e7-6423-4d03-8598-7ab172f8ab4c

Business Outlook

The Company currently expects total loan origination volume to be in the range of RMB13 billion to RMB14 billion for the fourth quarter of 2019. The Company now expects total loan originations for the fiscal year 2019 to be in the range of RMB53.9 billion and RMB54.9 billion. The above outlook is based on current market conditions and reflects the Company’s preliminary expectations as to market conditions, its regulatory and operating environment, as well as customer demand, all of which are subject to changes and uncertainties.

Conference Call

The Company’s management will host an earnings conference call at 8:00 AM U.S. Eastern Time on December 5, 2019 (9:00 PM Beijing / Hong Kong Time on the same day).

Dial-in details for the earnings conference call are as follows:

| United States (toll free): | +1-866-519-4004 |

| Hong Kong (toll free): | 800-906-601 |

| China: | 400-620-8038 |

| International: | +65-6713-5090 |

| Passcode: | 9459804 |

Please dial in ten minutes before the call is scheduled to begin and provide the passcode to join the call.

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at http://ir.9fgroup.com.

About 9F Inc.

9F Inc. is a leading digital financial account platform integrating and personalizing financial services in China with the footprint expanding overseas. The Company provides a comprehensive range of financial products and services across loan products, online wealth management products, and payment facilitation, all integrated under a single digital financial account.

For more information, please visit http://ir.9fgroup.com/

Use of Non-GAAP Financial Measures

The Company uses adjusted net income, a non-GAAP financial measure, in evaluating its operating results and as a supplemental measure to review and assess its financial and operational performance. The Company believes that adjusted net income provides useful information about its core operating results, enhances the overall understanding of its past performance and future prospects and allows for greater visibility with respect to key metric used by the Company’s management in its financial and operational decision-making. The Company also believes that adjusted net income, which excludes the effect of share-based compensation expenses, helps identify underlying trends in its business and help the Company’s management formulate business plans.

Adjusted net income is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. This non-GAAP financial measure has limitations as an analytical tool, and when assessing the Company’s operating performance, cash flows or liquidity, investors should not consider it in isolation, or as a substitute for net income, cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP. Other companies, including peer companies in the industry, may calculate this non-GAAP measures differently, which may reduce their usefulness as a comparative measure. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

The Company compensates for these limitations by reconciling the non-GAAP financial measure to the most directly comparable U.S. GAAP financial measure, which should be considered when evaluating the Company’s performance. For more information on this non-GAAP financial measure, please see the table captioned “Reconciliations of GAAP and Non-GAAP results” set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.1477 to US$1.00, the rate in effect as of September 30, 2019 as set forth in the H.10 statistical release of the Federal Reserve Board.

Safe Harbor Statement

This press release contains forward-looking statements. These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “target,” “confident” and similar statements. Such statements are based upon management’s current expectations and current market, regulatory and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited to, uncertainties as to the Company’s ability to attract and retain borrowers and investors on its marketplace, its ability to increase volume of loans facilitated through the Company’s marketplace, its ability to introduce new loan products and platform enhancements, its ability to compete effectively, laws, regulations and governmental policies relating to the online consumer finance industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the Nasdaq, including its ability to cure any non-compliance with the Nasdaq’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and 9F Inc. does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

For investor and media enquiries, please contact:

In China:

9F Inc.

Head of Investor Relations

Cecilia Ma

E-mail: ir@9fbank.com.cn

Christensen

In China

Mr. Christian Arnell

Phone: +86-10-5900-1548

E-mail: carnell@christensenir.com

In US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: lbergkamp@christensenir.com

| 9F Inc. | |||||

| UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS | |||||

| (All amounts in thousands, except for number of shares and per share data, or otherwise noted) | |||||

| December 31 | September 30 | September 30 | |||

| 2018 | 2019 | 2019 | |||

| RMB | RMB | USD | |||

| ASSETS | |||||

| Cash and cash equivalents | 5,469,077 | 4,449,337 | 622,485 | ||

| Term deposits | 833,478 | 235,723 | 32,979 | ||

| Accounts receivable, net | 180,141 | 1,903,131 | 266,258 | ||

| Other receivables, net | 146,438 | 162,284 | 22,704 | ||

| Loan receivables, net | 593,943 | 1,301,220 | 182,047 | ||

| Amounts due from related parties | 146,273 | 56,063 | 7,844 | ||

| Prepaid expenses and other assets | 543,088 | 1,587,092 | 222,042 | ||

| Contract assets, net | 12,642 | 35,088 | 4,909 | ||

| Long‑term investments | 954,158 | 1,075,709 | 150,497 | ||

| Operating lease right-of-use assets | - | 114,954 | 16,083 | ||

| Property, equipment and software, net | 86,267 | 99,232 | 13,883 | ||

| Goodwill | 13,385 | 78,577 | 10,993 | ||

| Intangible assets, net | 44,733 | 77,140 | 10,792 | ||

| Deferred tax assets, net | 84,338 | 228,602 | 31,983 | ||

| TOTAL ASSETS | 9,107,961 | 11,404,152 | 1,595,499 | ||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||

| Liabilities: | |||||

| Deferred revenue | 346,847 | 732,695 | 102,508 | ||

| Payroll and welfare payable | 38,890 | 6,926 | 969 | ||

| Income tax payable | 315,868 | 343,588 | 48,070 | ||

| Accrued expenses and other liabilities | 745,307 | 974,461 | 136,332 | ||

| Operating lease liabilities | - | 115,597 | 16,173 | ||

| Amounts due to related parties | 14,706 | 16,428 | 2,298 | ||

| Deferred tax liabilities | 9,003 | 16,161 | 2,261 | ||

| Total liabilities | 1,470,621 | 2,205,856 | 308,611 | ||

| Mezzanine equity | |||||

| Series A convertible redeemable preferred shares | 280,301 | - | - | ||

| Series B convertible redeemable preferred shares | 202,086 | - | - | ||

| Series C convertible redeemable preferred shares | 355,248 | - | - | ||

| Series D convertible redeemable preferred shares | 408,358 | - | - | ||

| Series E convertible redeemable preferred shares | 136,427 | - | - | ||

| Shareholders’ equity: | |||||

| Ordinary shares | - | 2 | - | ||

| Additional paid‑in capital | 3,046,725 | 5,205,940 | 728,338 | ||

| Statutory reserves | 446,277 | 443,778 | 62,087 | ||

| Retained earnings | 2,671,275 | 3,375,360 | 472,230 | ||

| Accumulated other comprehensive income | 80,193 | 140,033 | 19,591 | ||

| Total 9F Inc. shareholders’ equity | 6,244,470 | 9,165,113 | 1,282,246 | ||

| Non‑controlling interest | 10,450 | 33,183 | 4,642 | ||

| Total shareholders’ equity | 6,254,920 | 9,198,296 | 1,286,888 | ||

| TOTAL LIABILITIES, MEZZANINE EQUITY AND SHAREHOLERS’ EQUITY | 9,107,961 | 11,404,152 | 1,595,499 | ||

| 9F Inc. | ||||||||||||||||||

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||||

| (Amounts in thousands, except for number of shares and per share data, or otherwise noted) | ||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||

| 2018 | 2019 | 2019 | 2018 | 2019 | 2019 | |||||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||||

| Net Revenues | ||||||||||||||||||

| Loan facilitation services | 818,006 | 1,484,080 | 207,630 | 4,035,314 | 3,389,920 | 474,267 | ||||||||||||

| Post-origination services | 99,099 | 149,626 | 20,933 | 291,951 | 303,136 | 42,410 | ||||||||||||

| Others | 27,861 | 71,767 | 10,041 | 201,455 | 262,948 | 36,788 | ||||||||||||

| Total Net Revenues | 944,966 | 1,705,473 | 238,604 | 4,528,720 | 3,956,004 | 553,465 | ||||||||||||

| Operating costs and expenses | ||||||||||||||||||

| Cost of products | - | - | - | - | (105,592 | ) | (14,773 | ) | ||||||||||

| Sales and marketing | (342,035 | ) | (773,538 | ) | (108,222 | ) | (1,415,376 | ) | (1,516,721 | ) | (212,197 | ) | ||||||

| Origination and servicing | (97,178 | ) | (431,270 | ) | (60,337 | ) | (338,099 | ) | (659,317 | ) | (92,242 | ) | ||||||

| General and administrative | (256,372 | ) | (509,426 | ) | (71,271 | ) | (744,963 | ) | (938,312 | ) | (131,275 | ) | ||||||

| Total operating costs and expenses | (695,585 | ) | (1,714,234 | ) | (239,830 | ) | (2,498,438 | ) | (3,219,942 | ) | (450,487 | ) | ||||||

| Interest income | 72,147 | 47,830 | 6,692 | 144,433 | 186,514 | 26,094 | ||||||||||||

| Impairment loss of investments | (23,094 | ) | - | - | (23,094 | ) | - | - | ||||||||||

| Gain recognized on measurement of previously held equity interest in acquiree | (257 | ) | 9,250 | 1,294 | (257 | ) | 25,522 | 3,571 | ||||||||||

| Non‑operating (loss)/income, net | (412 | ) | 5,141 | 719 | 15,860 | 2,549 | 357 | |||||||||||

| Income before income tax expense and share of profit in equity method investments | 297,765 | 53,460 | 7,479 | 2,167,224 | 950,647 | 133,000 | ||||||||||||

| Income tax expense | (66,929 | ) | (30,430 | ) | (4,257 | ) | (354,258 | ) | (160,966 | ) | (22,520 | ) | ||||||

| Share of profit(loss) in equity method investments | (2,100 | ) | (12,513 | ) | (1,751 | ) | (4,945 | ) | (80,196 | ) | (11,220 | ) | ||||||

| Net income | 228,736 | 10,517 | 1,471 | 1,808,021 | 709,485 | 99,260 | ||||||||||||

| net (income)/loss attributable to non-controlling interest shareholders | 3,293 | 5,302 | 742 | 3,371 | 2,812 | 393 | ||||||||||||

| Net income attributable to 9F Inc. | 232,029 | 15,819 | 2,213 | 1,811,392 | 712,297 | 99,653 | ||||||||||||

| Change in redemption value of preferred shares | (4,342 | ) | (2,170 | ) | (304 | ) | (12,884 | ) | (10,711 | ) | (1,499 | ) | ||||||

| Net income attributable to ordinary shareholders | 227,687 | 13,649 | 1,909 | 1,798,508 | 701,586 | 98,154 | ||||||||||||

| Earnings per share: | ||||||||||||||||||

| Basic | 1.22 | 0.07 | 0.01 | 9.70 | 3.73 | 0.52 | ||||||||||||

| Diluted | 1.06 | 0.06 | 0.01 | 8.48 | 3.25 | 0.45 | ||||||||||||

| Shares used in earnings per share computation: | ||||||||||||||||||

| Basic | 162,672,800 | 177,285,891 | 177,285,891 | 162,672,800 | 167,597,358 | 167,597,358 | ||||||||||||

| Diluted | 187,184,685 | 202,647,210 | 202,647,210 | 186,131,427 | 192,033,608 | 192,033,608 | ||||||||||||

| 9F Inc. | ||||||||||||||||

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | ||||||||||||||||

| (Amounts in thousands, except for number of shares and per share data, or otherwise noted) | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2018 | 2019 | 2019 | 2018 | 2019 | 2019 | |||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||

| Net income | 228,736 | 10,517 | 1,471 | 1,808,021 | 709,485 | 99,260 | ||||||||||

| Other comprehensive income: | ||||||||||||||||

| Foreign currency translation adjustment, net of tax of nil | 47,695 | 62,619 | 8,761 | 82,803 | 59,938 | 8,386 | ||||||||||

| Unrealized gains on available for sale investments, net of tax of nil | 244 | (1,097 | ) | (153 | ) | 426 | (98 | ) | (14 | ) | ||||||

| Total comprehensive income | 276,675 | 72,039 | 10,079 | 1,891,250 | 769,325 | 107,632 | ||||||||||

| Total comprehensive income/(loss) attributable to the non-controlling interest shareholders | 3,293 | 5,302 | 742 | 3,371 | 2,812 | 393 | ||||||||||

| Total comprehensive income attributable to 9F Inc. | 279,968 | 77,341 | 10,821 | 1,894,621 | 772,137 | 108,025 | ||||||||||

| 9F Inc. | ||||||||||||||||||||

| Reconciliations of GAAP And Non-GAAP Results | ||||||||||||||||||||

| (Amounts in thousands, except for number of shares and per share data, or otherwise noted) | ||||||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, 2018 | June 30, 2019 | September 30, 2019 | September 30, 2019 | September 30, 2018 | September 30, 2019 | September 30, 2019 | ||||||||||||||

| RMB | RMB | RMB | USD | RMB | RMB | USD | ||||||||||||||

| Net income | 228,736 | 171,586 | 10,517 | 1,471 | 1,808,021 | 709,485 | 99,260 | |||||||||||||

| Add: | ||||||||||||||||||||

| Share-based compensation | 133,837 | 34,243 | 234,511 | 32,809 | 378,124 | 302,414 | 42,309 | |||||||||||||

| Less: | ||||||||||||||||||||

| Tax effect of adjustments | - | - | - | - | - | - | - | |||||||||||||

| Adjusted net income | 362,573 | 205,829 | 245,028 | 34,280 | 2,186,145 | 1,011,899 | 141,569 | |||||||||||||

1 “Loan origination volume” refers to the total amount of loans originated to the Company’s borrowers, including the loan origination volume funded by individual investors and institutional funding partners.

2 “Institutional funding partners” refers to banks and other institutions which have partnered with the Company on its direct lending program to fund loans originated to the Company’s borrowers.

3 “Registered users” refers to the accumulative number of users who have registered their digital accounts with the Company (identified by registered mobile phone numbers) as of a certain point of time.

4 “Active borrowers” refers to, for a specified period, borrowers who made at least one borrowing transaction with the Company during that period.

5 “Outstanding loan balance” refers to the total balance of outstanding principal of all the loan products, including revolving loan products, non-revolving loan products and loan products under the Company’s direct lending program. Outstanding loan balance for loans funded by institutional funding partners, regardless of its nature of revolving or non-revolving loan products, are counted towards outstanding loan balance under the Company’s direct lending program.

6 “Adjusted net income” is a non-GAAP financial measure. For more information on this non-GAAP financial measure, please see the section of “Use of Non-GAAP Financial Measures” and the table captioned “Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

7 “delinquency rate” refers to loan principal that was 15-30, 31-60, 61-90 and 91-180 calendar days past due as a percentage of the total balance of outstanding principal of loans originated on the Company’s platform as of a specific date. Loan products that have been transferred to non-performing loan companies are not included in the calculation of delinquency rate.

8 "M3+ Delinquency Rates by Vintage" refers to the total balance of outstanding principal of a vintage for which any payment of principal is over 90 calendar days past due as of a particular date (adjusted to exclude total amount of past due payments for loan principal that have been subsequently collected in the same vintage), divided by the total initial principal originated in such vintage. Loan products that have been transferred to non-performing loan companies are not included in the calculation of M3+ Delinquency Rates by Vintage.